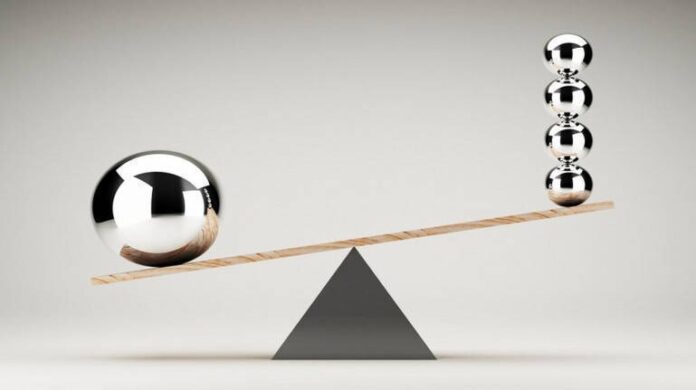

A balanced advantage fund, also known as a dynamic asset allocation fund, is a hybrid mutual fund that invests in both stocks and bonds. Unlike traditional hybrid funds, which have fixed percentages for how much to invest in each asset type, a balanced advantage fund has no set limits. This gives fund managers the flexibility to adjust the mix of stocks and bonds based on market conditions. In a bullish market, when stock prices are high, the fund may reduce its stock exposure and invest more in bonds, which are generally safer. When stock prices fall, the fund can increase its stock holdings to take advantage of lower prices. This flexible asset allocation sets balanced advantage funds apart from other hybrid funds, allowing investors to benefit from both growth and stability.

Why should you consider a balanced advantage fund?

Balanced advantage fund are an attractive option for risk-averse investors because they aim to reduce volatility by lowering equity exposure during market peaks. This makes them ideal for individuals who want to benefit from equities’ growth potential without fully exposing themselves to the risks associated with market fluctuations. The primary goal of a balanced advantage fund is to generate risk-adjusted returns over time. These funds can potentially maximize returns by adjusting their asset allocation according to market conditions, offering flexibility to manage both risk and growth opportunities.

Key factors to consider before investing in a balanced advantage fund

- Dynamic asset allocation: These funds provide flexibility by adjusting the balance between equities and debt based on market conditions. Fund managers can increase or decrease stock exposure, potentially increasing returns while managing risks.

- Risk mitigation: Balanced advantage funds aim to reduce portfolio volatility by maintaining a lower equity allocation when market risks are high. This approach is beneficial for investors with a low-risk appetite who want to strike a balance between growth and capital preservation.

- Potential for risk-adjusted returns: The core strategy of balanced advantage funds is to deliver returns adjusted for risk, potentially offering better returns with less volatility than pure equity funds. Fund managers can capitalize on market inefficiencies by adjusting exposure to equities based on market conditions and delivering competitive long-term returns.

Exploring features of Balanced Advantage Fund

Balanced advantage funds offer several benefits for investors looking for a flexible and dynamic investment approach. Key features include:

- Dynamic asset allocation: The fund adjusts its exposure to equities and debt instruments depending on market conditions, helping to maintain an optimal balance between growth potential and risk management.

- Risk management: The fund seeks to limit the impact of market volatility on invested capital, providing a smoother investment experience for investors.

- Navigating market volatility: With an emphasis on reducing the effect of sudden market changes, the fund may offer more stability during uncertain times.

- Long-term perspective: Balanced advantage funds are suitable for investors with a long-term outlook. They aim to capitalize on equities’ growth potential while maintaining control over risk.

Who should consider investing in a balanced advantage fund?

A balanced advantage fund is well-suited for a wide range of investors. You might want to consider this scheme if you:

- Prefer a dynamic asset allocation strategy in your portfolio.

- They are looking for diversification to manage risk effectively.

- Want professional fund management to handle market complexities.

- Aim for long-term capital appreciation while managing downside risk.

- Have a long-term investment horizon and are focused on steady growth over time.

What is a New Fund Offer (NFO)?

A New Fund Offer NFO is the first-time launch of a mutual fund by an asset management company. During the NFO period, investors can purchase units of the mutual fund at a fixed price, typically starting at Rs. 10 per unit. NFOs usually last between 10 to 15 days. They are used by mutual fund houses to raise capital from the public, which is then invested according to the fund’s objectives.

NFOs can be an attractive investment opportunity, allowing investors to buy mutual fund units at face value. Once the subscription period ends, the NFO closes, and units can no longer be purchased at the initial price. Afterward, the fund begins trading on the open market, where unit prices may fluctuate based on the fund’s performance.

Conclusion

Balanced advantage funds offer a flexible and dynamic approach to investing, which is attractive to risk-averse investors seeking both growth and capital preservation. These funds can adjust asset allocation between equities and debt based on market conditions, providing a balance of potential returns and risk management. Furthermore, New Fund Offers (NFOs) provide investors with the opportunity to enter these funds at an early stage, often at an attractive price point. Investors considering balanced advantage funds should seek advice from financial advisors to ensure these investments align with their long-term goals and risk tolerance.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.