Starting and running a small business is a journey filled with excitement and challenges. For many entrepreneurs, the dream of establishing a successful enterprise can often feel daunting, especially when it comes to securing the necessary funding. Traditional loans can come with high-interest rates and strict repayment terms, leaving many business owners searching for alternative financing options. This is where small business grants works the best. Unlike loans, grant for small business provide funding that doesn’t need to be repaid, making them an attractive option for startups and established businesses alike. These grants can cover various expenses, from startup costs to operational expenditures, and can significantly impact a business’s growth trajectory.

In this blog, we will explore how small business grants can help turn your entrepreneurial dreams into reality, providing you with essential information to navigate the world of grant funding.

What Are Small Business Grants?

Small business grants are funds provided by government agencies, nonprofits, and private organizations to support small businesses. Unlike loans, grants do not require repayment, making them an appealing option for entrepreneurs. These grants can be used for a variety of purposes, including:

- Startup Costs: Covering expenses associated with launching a new business, such as equipment, inventory, and initial marketing.

- Operational Expenses: Assisting with day-to-day costs like rent, utilities, and payroll.

- Expansion Initiatives: Funding efforts to grow an existing business, whether through new locations, product lines, or technology upgrades.

The grants can be vast and complex, with numerous options available depending on your industry, location, and business needs. Understanding the types of grants available and how to apply for them can open up valuable funding opportunities.

Types of Grants for Small Businesses

Federal Grants: These are funds provided by government agencies at the federal level. They often target specific industries or business initiatives, such as technology, healthcare, and renewable energy. Federal grants can be competitive but typically offer substantial funding amounts.

State and Local Grants: Many state and local governments offer grants to support small businesses within their regions. These grants may be designed to promote economic development, job creation, or specific initiatives like tourism or manufacturing.

Private and Nonprofit Grants: Most private organizations and nonprofits provide grants for small businesses, often focusing on specific causes or demographics. For example, some grants support minority-owned businesses, women entrepreneurs, or businesses that prioritize environmental sustainability.

Research and Development Grants: If your business involves innovation or research, consider applying for grants that support R&D activities. These grants can help fund projects that contribute to technological advancements or scientific discoveries.

Benefits of Applying for Small Business Grants

Non-Repayable Funding: One of the most significant advantages of grants is that they do not require repayment, allowing you to use the funds for growth without the burden of debt.

Financial Flexibility: Grants can provide the financial flexibility needed to invest in your business’s future, whether it’s purchasing new equipment, hiring employees, or expanding your product line.

Enhancing Credibility: Receiving a grant can enhance your business’s credibility, as it often involves a rigorous application process that assesses your business’s viability and potential for success.

Networking Opportunities: Many grant programs offer networking opportunities with other grant recipients, industry leaders, and potential investors, which can lead to valuable partnerships and collaborations.

How to Find and Apply for Grants

Finding the right grant involves thorough research and preparation. Here are some steps to help you navigate the process:

Identify Your Needs: Before searching for grants, assess your business needs. Determine what type of funding will best support your goals—whether it’s for startup costs, expansion, or operational expenses.

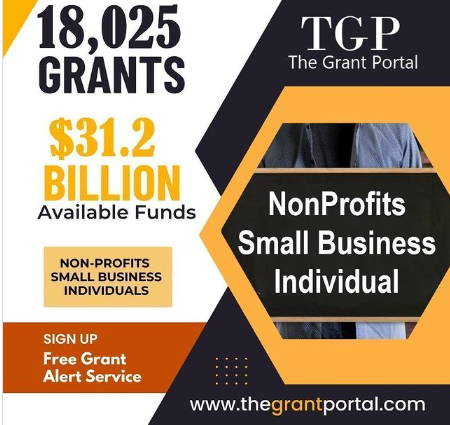

Research Available Grants: Utilize online resources, such as grant databases, government websites, and nonprofit organizations, to identify grants that align with your business objectives. Websites like The Grant Portal can be particularly helpful in discovering available funding opportunities.

Understand Eligibility Requirements: Each grant will have specific eligibility criteria. Carefully review these requirements to ensure your business qualifies before investing time in the application process.

Prepare a Strong Application: A compelling grant application should clearly outline your business plan, goals, and how the funding will be utilized. Include any supporting documents, such as financial statements and market research, to strengthen your case.

Follow Up: After submitting your application, consider following up with the grant provider to express your continued interest and to inquire about the decision timeline.

Achieving Required Financial Support

Small business grants can be a game-changer for entrepreneurs looking to fund their dreams without the burden of debt. By understanding the types of grants available, the benefits they offer, and how to complete the application process, you can unlock the potential for substantial financial support. With the right information and preparation, your small business can take significant steps toward growth and success.

For more resources and information on grants for small businesses, visit The Grant Portal, where you can explore a variety of funding opportunities tailored to your needs.